The Most Valuable Report on a Contractors Desk

If you don’t recognise the term WIP, join the crowd. Work In Progress confuses most contractors – mainly because it was originally used by accountants and bankers as a financial instrument for the manufacturing sector. With increased construction complexity and project risks, contractors need additional financial visibility.

Before diving in, a word of warning: this article may not apply to all construction companies. If your construction projects typically run a month or more, put on your thinking cap. If not, your company is more likely service focused – WIP Reporting is not a tool of interest.

The below information is designed to explain how WIP Reporting can be one of the most valuable financial reports a contractor can use. If cost control and income predictability are of interest to you, keep reading.

What Is Needed to Calculate WIP

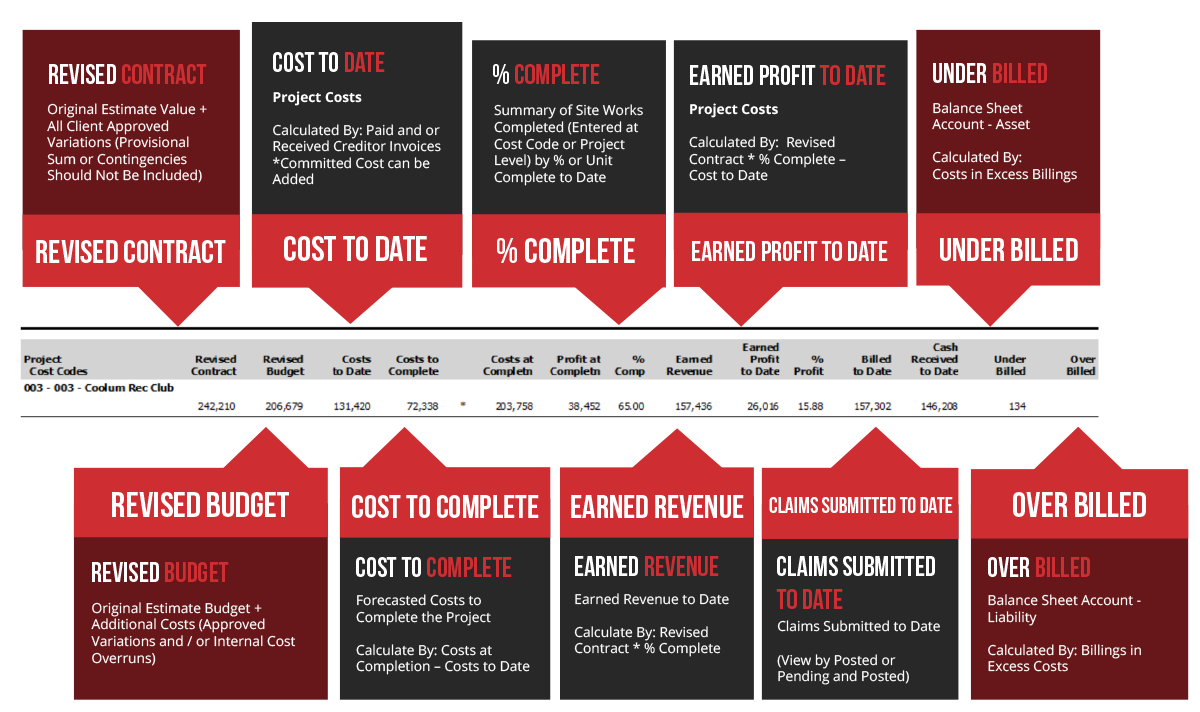

WIP identifies the value of active construction projects that have not received final revenue or costs. In order to properly account for each project, SIX values are needed along with weekly or monthly WIP comparison reports

The 6 Values Used to Calculate WIP

- Current contract value

- Current project budget

- Costs-To-Date

- Billed-To-Date

- Percent Spent

- Percent or Unit Complete On Site

By taking the Costs-To-Date divided by the Current Estimate Budget, the “percentage spent” is compared to the Percent or Unit Completed on site, only then is the project earned value calculated. For example:

- Assume a project gross value is estimated to cost $242,210 by the time the work is complete

- Midway through the project $131,420 has been spent to date for the project

- Based from onsite evaluation 65% of the project is complete

- This 65% is compared against the cost to date vs. contract value *See diagram below

The percent spent compared to the work complete (contractors assessment of real work completed or goods delivered to site) allows for the calculation of Cost to Complete and Cost at Completion = Earned Value.

Calculation of the Cost to Complete is a valuable tool in determining how much the client should be billed – ideally the billed and approved amount is greater than the costs expended to do the work. This ensures that the client is directly funding the construction work, and that the contractor is not out of pocket.

WIP Wash Up

The percent or unit complete method is generally the preferred method of financial and tax accounting for long-term construction contracts. The cost to complete method recognises accrued revenues and costs in the applicable periods of construction, and not solely in the period when the construction cost and revenue are paid or received.

Up to date job cost reporting are becoming a tool of trade for contractors looking to secure their business and not lose financial control. Construction managers generally don’t sign up to be accountants, but with some general knowledge of accounting principles and current job cost accounting software, WIP Reporting month on month comparisons is not difficult to achieve. Clear KPI’s for project managers based on accurate project financials are now standard tools for successful contractors.

If you need further assistance regarding WIP Reporting please click here to contact us.